delayed draw term loan vs revolver

No failure or delay on the part of the. Revolvers dont have a fixed number of payments and the loan can be withdrawn repaid and withdrawn again.

Frank Cupido Cfa Partner Tree Line Capital Partners Linkedin

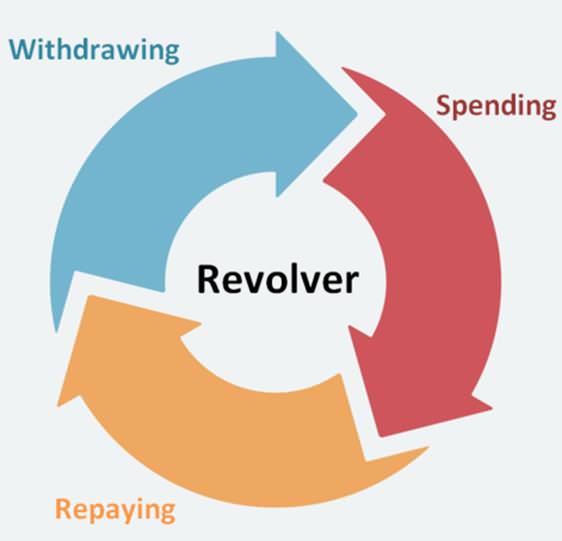

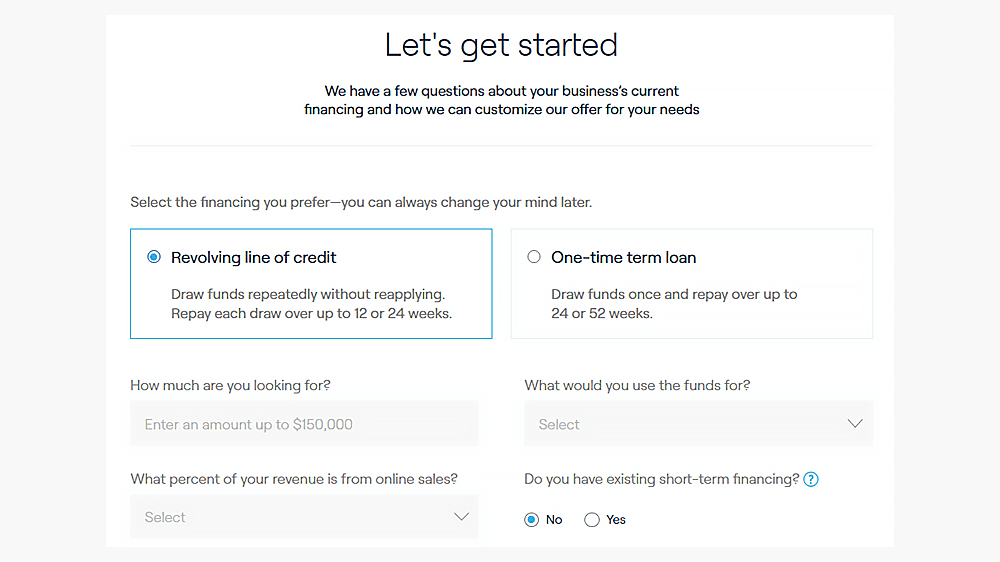

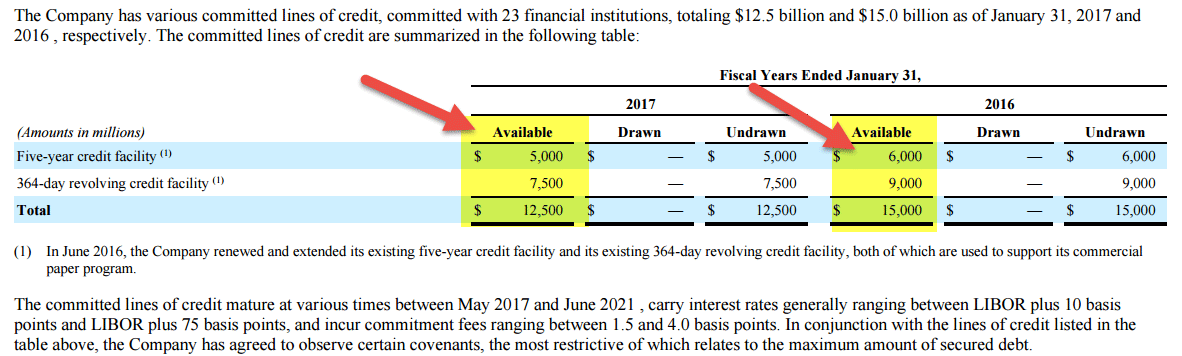

Revolving credit facilities can be drawn paid back and then drawn again.

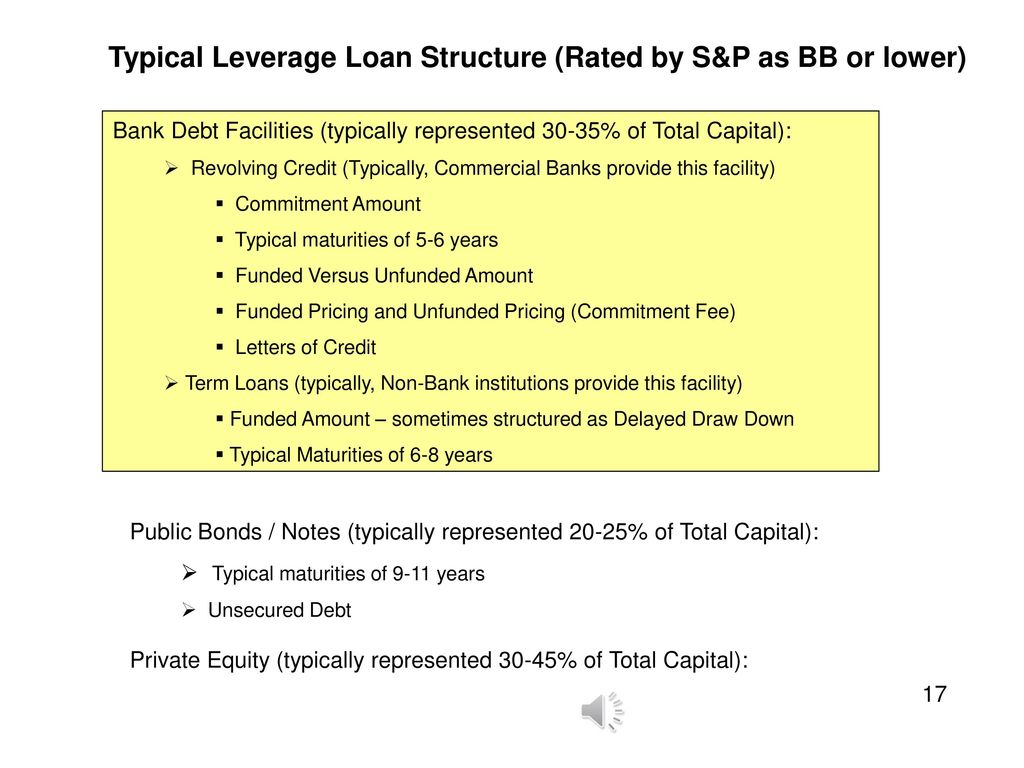

. May consist of immediately funded or delayed-draw term loans or of revolving credit commitments May be implemented as either a new credit facility or as an upsizing of an existing credit facility May be implemented via an amendment agreement an incremental assumption agreement or an amendment and restatement of the existing credit. Flexibility is the key here. The debt then becomes term loans with the same terms and pricing.

While revolver terms are typically five years they are intended for short-term capital needs like working capital and not acquisitions. Delayed Draw Loans and Term Loan. A revolver doesnt require a debt incurrence test so accessing the funds might be even faster potentially within a day.

This CLE course will discuss the terms and structuring of delayed draw term loans. A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times. Term debt is a loan with a set payment schedule over several months or years.

The Delayed Draw Term Loan of each Term Loan Lender shall be payable in equal consecutive quarterly installments commencing with the first full fiscal quarter ending following the first borrowing of Delayed Draw Term Loans on the last day of each March June September and December each in an amount equal to one and one-quarter percent 125 of the aggregate. Concurrently Moodys assigned a B2 rating to athenahealths first lien credit facilities consisting of a 5750 million term loan B 1000 million delayed draw term loan B and 1000 million. Thats good news for non-bank providers which have struggled to.

ARTICLE I DEFINITIONS AND ACCOUNTING TERMS. DDTLs were used in bespoke arrangements by borrowers who wanted to get incremental committed term loan capacity often for future acquisitions or expansions but wanted to delay the incurrence of the additional. The difference between term and revolving debt.

This term refers to the ranking of debt in the event of bankruptcy and liquidation. A swingline loan is a short-term loan that offers quick access to capital typically used for debt obligations. DDTLs were used in bespoke arrangements by borrowers who wanted to get incremental committed term loan capacity often for future acquisitions or expansions but wanted.

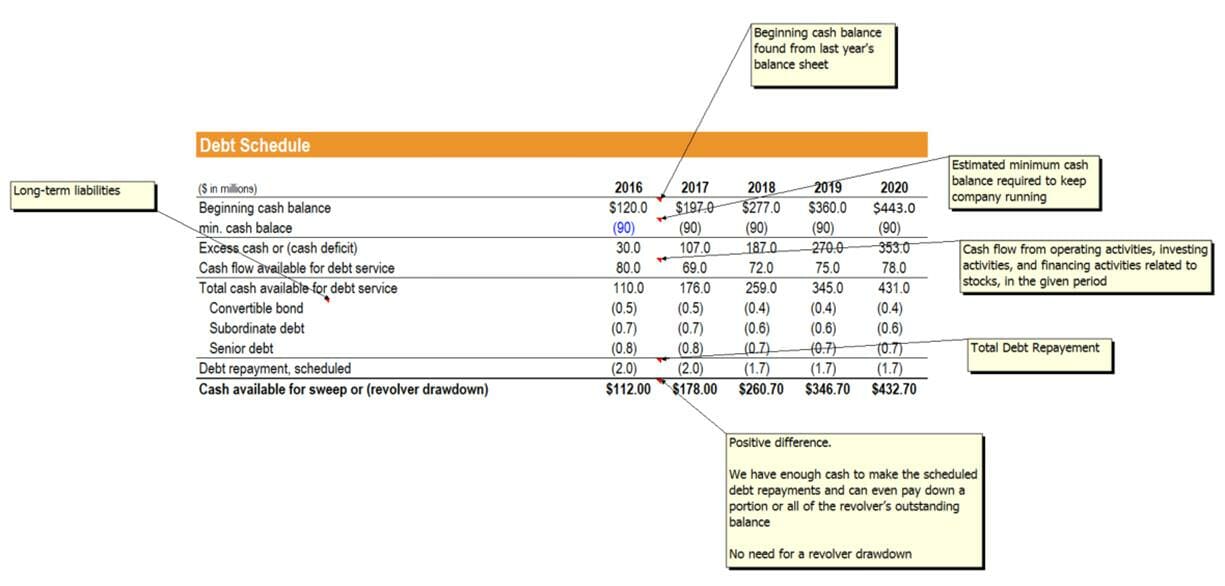

Term Loans Closing Date Term Loans Delayed Draw Term Loans Revolving Loans Letters of Credit Swingline Incremental Facilities Accordions Advantage. A company will draw down the revolver up to the credit limit when it needs cash and repays the revolver when excess cash is available there is no repayment penalty. 137500000 DELAYED DRAW TERM LOAN FACILITY Table of Contents Page.

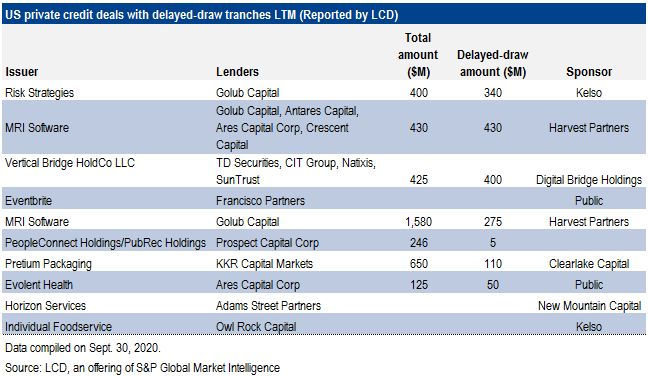

Subject to the limitations set forth in this Section 205 a the Borrowers may upon notice from the Borrowers to the Administrative Agent at any time or from time to time voluntarily prepay Revolving Loans Delayed Draw Loans andor the Term Loan in whole or in part subject to a one percent 1 prepayment fee on the. Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. DDTLs vs Revolvers and Accordions.

Funding Sources are broadening to include revolving loans accordion exercise and even delayed draw term loans Takeaway As Borrowers push for more flexibility to see earlier returns on their investment beware of the impacts on long term debt service capabilities and ensure the proper protections are in place to limit dividends when. The sellers receipt of proceeds from the sale is delayed. The lenders approve the term loans once with a maximum credit limit and charge variable interests on them.

Delayed Draw Term Loans. Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. Swingline loans are available to business owners and individuals and can function as revolving credit or a syndicated loan.

Unlike revolvers which are generally unfunded delayed-draw term loans fund over time with the unfunded portion eventually reduced to zero. It is the same as junior debt and. The revolving loans are approved for the short-term usually up to one year.

Lets examine how swingline loans work and their pros and cons. For a borrower a DDTL is a way to access acquisition financing relatively fast as little as three to five days. Delayed-draw term loans are lender-friendly.

For example say you borrow 50000 and pay the money back with. An accordion feature is an option that a company can buy that gives it the right to increase its line of credit or similar type of liability with a. Used responsibly however a revolving line of credit is a fantastic way to meet short-term needs maintain liquidity and keep financing costs low.

Short Term Needs. Layer of debt you take on makes a big difference non-refundable as the. A revolving loan comes with a replenishing feature where the borrower can withdraw amounts and repay to fully utilize the facility again.

This can be helpful when unexpected expenses occur or if there are income fluctuations. The panel will review the evolving uses of delayed draw term loans DDTLs in leveraged buyouts LBOs and other private equity transactions and critical points of negotiation including conditions precedent to making draws ticking fees loan term and fronting arrangements in. Unlike revolvers DDTLs are considered long-term capital.

But that debt needs to be refinanced. Ideally the business owner only draws what is needed on the line to meet operating expenses and then pays down the line as operating cash flow improves minimizing the time the. No Lender consent required Most Favored Nation MFN Pricing typically applies Types.

The unfunded portion eventually reduced to zero buying inventory making payroll or handling last-minute expenses delayed draw term loan vs revolver than you can borrow or nine monthsare also determined in advance fixed number of payments and loan. Term Loan A This layer of debt is typically amortized evenly over 5 to 7 years. Commercial paper or letter of credit facilities or indentures providing for revolving credit loans term loans letters of credit or other Indebtedness including any notes mortgages.

Houlihan Lokey Advises Cerberus Capital Management Transaction Details

Are Syndicated Loans Senior Loans Seniorcare2share

Delayed Draw Term Loan Ddtl Overview Structure Benefits

Pandemic Leads Lenders To Tighten Rules On Delayed Draw Term Loans S P Global Market Intelligence

Revolving Credit Facility Efinancemanagement

Looking At The Bank Loan Syndication Process Ppt Download

Houlihan Lokey Advises Sun Capital Partners Transaction Details

Advanced Lbo Modeling Test 4 Hour Example Excel Template

Fundbox Review Our Expert Shares Insights On His 2k Loan Application

Swingline Loan Ceopedia Management Online

Delayed Draw Term Loans Financial Edge

Revolving Credit Facility Guide To How A Revolver Woks

Sponsors Holster Revolvers For Delayed Draw Loans Churchill Asset Management

Revolving Credit Facility Guide To How A Revolver Woks

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

Advanced Lbo Modeling Test 4 Hour Example Excel Template

Update 1 Pg E S Revised Dip Facility Clarifies Minimum Asset Sale Sweep Threshold Term Loan Pricing Lowered Reorg

Revolving Credit Facilities Definition Examples How It Works