texas estate tax law

The estate is everything the person owned at the time of death. My home went up 36 percent according to the appraisal district.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Texas estate planning electronic resource With fingertip access to hundreds of forms along with explanations of how to best apply these forms Texas Estate Planning assists you in preparing client wills trusts durable powers of.

. Texas law establishes the process followed by local officials in determining the value for property ensuring that values are equal and uniform setting tax rates and collecting taxes. Generally the estate tax affects only individuals with a large estate. 2022 property tax appraisals for most counties are out.

Relationships between landlords and tenants. This includes personal property real estate cash retirement accounts investments and life insurance policies. This article authored by Forbes Forbes Law includes an infographic that breaks down the probate process into eight easy-to-understand steps.

Estates worth more than 525 million will be subject to a 40 tax. Conduct of the Property Value Study a Definitions. Texas Probate Guide.

Below as well as on the additional pages of this guide you will find links to Texas and federal. REAL AND TANGIBLE PERSONAL PROPERTY. Probate Laws in Texas.

PRACTICE AND PROCEDURE 9101. The Comptroller may adopt rules to administer. The good news is that Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

The following words and terms when used in this subchapter shall have the following meanings unless the context clearly indicates otherwise. The estate tax is a tax on the transfer of wealth following death. 30-40 percent jump on average.

This manual published by the State Bar of Texas covers foreclosure laws and procedures in Texas including debt collection secured loans bid evaluation alternatives to foreclosure and the specifics of foreclosure. In Texas for example there is no limit on how much a landlord may. If you fall behind on your property taxes the local taxing authority can foreclosure on the property.

State Administration Section 503 SB 63 and HB 3786 add subsection d allowing the Comp-troller after giving notice to send and require submission of documents payments notices reports or other items elec-tronically. Handbook of Texas Property Tax Rules 1 Texas Property Tax SUBCHAPTER A. B This state has jurisdiction to tax real property if located in this state.

Property tax laws are broken in our state. The executor or administrator is required to among other things prepare and file all of the tax returns due both for the decedent and for the estate. AUSTIN Texas A change to the states homestead exemption law on Jan.

Texas law requires an inventory of all estate assets. TAX SALES AND REDEMPTION. A Real property seized under a tax warrant issued under Subchapter E Chapter 33 or ordered sold pursuant to foreclosure of a tax lien shall be sold by the officer charged with selling the property unless otherwise.

And other matters pertaining to ones home or residence. Published in the Texas Administrative Code. Senate Bill 2 the Texas Property Tax Reform and Transparency Act of 2019 is 153 pages long.

A Guide to Probate and Estate Planning in Texas. TAX SALES AND REDEMPTION. TAXABLE PROPERTY AND EXEMPTIONS.

House Bill 3971 amends the Tax Code to require a chief appraiser who is determining the market value of residential real property located in an area that is zoned or otherwise designated as a historic district under municipal state or federal law to consider the effect on the propertys value of any restriction placed by the district on the property owners. The Texas Constitution and statutory. Texas has no state property tax.

Property and real estate law includes homestead protection from creditors. Probate is the process of recognizing a persons death and closing up their estate. Texas Property Tax Law Changes 2021 1 Tax Code Chapter 5.

This publication prepared by the Texas Young Lawyers Association seeks to make Texas residents aware of. 1 2022 continues to cause confusion for some property owners in Travis County. Adopted Rules The following proposals to repeal and replace administrative rule 94031 were filed with the Secretary of State for adoption on Feb.

For example in 2013 any transfer of assets of less than 525 million transfer estate tax-free. If you have HS exemption done youll see a 10 percent increase this year and youll also be taxed 10 percent for the years ahead. The Property Tax Assistance Division provides a Handbook of Texas Property Tax Rules PDFFor up-to-date versions of rules please see the Texas Administrative Code.

Its now a law but its also a cliché of sorts. Property and real estate laws also include zoning regulations which determine which kinds of structures may be built in a given location. There is a 40 percent federal tax however on.

Foreclosure is the legal process that allows for a piece of property to be sold in order to satisfy certain debts that are owed by the property owner. It includes information on tracking estate planning documents final arrangements real estate and tax records. A Closer Look The Matter of Texas Probate Taxes.

A All real and tangible personal property that this state has jurisdiction to tax is taxable unless exempt by law. What is the estate tax. This guide was created to help provide information on how the foreclosure process works in Texas.

Texas Retirement Tax Friendliness Smartasset

Texas Inheritance And Estate Taxes Ibekwe Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Affidavit Of Heirship For A House Texas Property Deeds

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Estate Tax Everything You Need To Know Smartasset

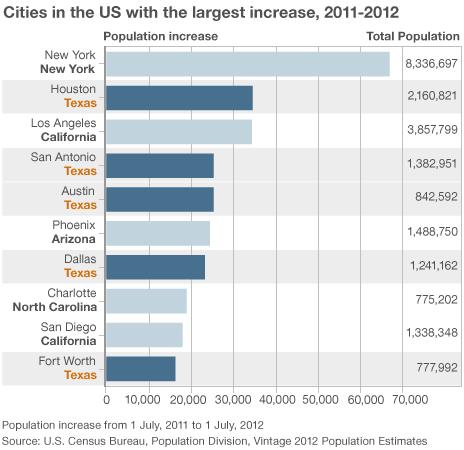

10 Reasons Why So Many People Are Moving To Texas Bbc News

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Talking Taxes Estate Tax Texas Agriculture Law

How Do State And Local Individual Income Taxes Work Tax Policy Center

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Do I Have To Pay Taxes When I Inherit Money

Texas Estate Tax Everything You Need To Know Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

Harris County Tx Property Tax Calculator Smartasset

Avoid Probate In Texas With The Small Estate Affidavit Ryan Reiffert Pllc